Posts by WEBIT_Admin

Retail & eCommerce in the Age of AI

From Demand Prediction to Hyper-Personalisation: Where the Next Wave of Growth Is Emerging

Retail has always been a data business. But for decades, that data was backwards-looking — sales reports, seasonal trends, historical averages. Artificial intelligence changes the direction of the lens. Instead of asking “What sold?” retailers now ask “What will sell — to whom, at what price, and through which channel?” AI is not just optimising retail. It is reshaping its operating model.The End of Forecasting by Approximation

For years, demand forecasting relied on historical sales, intuition, and static seasonal assumptions. But volatility — from pandemic shocks to supply chain disruptions — exposed how fragile those systems were. Today, leading retailers are deploying AI models that ingest:- Real-time sales data

- Weather patterns

- Social sentiment

- Local economic signals

- Marketing campaign performance

- Even search behaviour

Personalisation Becomes Infrastructure

Retail once segmented customers into broad personas. AI dissolves those categories. Every click, scroll, purchase, return, and review becomes part of a living behavioural model. Algorithms adapt in real time, reshaping product recommendations, homepage layouts, email triggers, and promotional messaging. Streaming platforms like Netflix demonstrated the power of personalisation years ago. Retail is now embedding that same intelligence directly into commerce flows. AI personalisation engines now:- Predict next-best product

- Adjust recommendations dynamically

- Optimise cross-sell bundles

- Tailor landing pages per user session

Pricing in Motion

Pricing used to be scheduled. Now it’s continuous. Dynamic pricing models evaluate:- Demand elasticity

- Competitor pricing

- Inventory levels

- Customer segment sensitivity

- Promotional timing

Supply Chains That Can See

If the past few years proved anything, it’s that supply chain opacity is expensive. AI is now being deployed not only to forecast demand but to create end-to-end supply chain visibility. Retailers integrate AI into:- Warehouse automation

- Shipment tracking

- Supplier performance monitoring

- Disruption detection

Loyalty Reimagined

Traditional loyalty programs were transactional: collect points, redeem rewards. AI transforms loyalty into behavioural intelligence. Retailers now use machine learning to:- Predict churn risk

- Identify high-value customers early

- Tailor individualised offers

- Optimise reward timing

- Detect discount fatigue

The Hidden Shift: Retail Becomes a Data Platform

What’s emerging is not just smarter marketing or better inventory management. It’s structural. Retailers are evolving into data platforms. The winners are those who:- Unify online and offline signals

- Build clean, governed data layers

- Integrate AI directly into operational workflows

- Measure ROI rigorously

When AI Creates Advantage — and When It Doesn’t

Not every AI deployment drives growth. If personalisation feels intrusive, customers disengage. If dynamic pricing feels unfair, trust declines. If forecasting models are disconnected from operations, decisions stall. AI becomes an advantage only when aligned with customer experience and operational execution. Retailers that treat AI as a feature experiment will struggle. Those who treat it as infrastructure will scale.The Competitive Divide Ahead

As AI adoption matures, retail is likely to divide into two tiers:- Data-rich operators with integrated AI across forecasting, pricing, supply chain, and loyalty

- Retailers relying on static systems and reactive planning

Join the Retail AI Dialogue at Webit 2026

The transformation of retail and eCommerce through AI is no longer experimental — it is structural. Demand forecasting, dynamic pricing, supply chain visibility, and loyalty intelligence are becoming core operating capabilities, not side projects for innovation. The retailers that will lead this decade are those that embed AI deeply into their commercial engines — aligning data, capital, technology, and customer experience into a unified growth model. If you want to explore how global retail leaders are scaling AI beyond pilots — and how AI is reshaping margin strategy, customer lifetime value, and operational resilience — join the executive AI Business Dialogue at Webit 2026 Sofia Edition on 23 June 2026. Webit gathers 3,500+ senior leaders to discuss real-world AI execution across industries — from retail and FMCG to finance, healthcare, and enterprise transformation. 👉 Learn more and secure your place: https://www.webit.org/2026/sofia/Transforming FMCG & Consumer Brands with AI: From Content at Scale...

The fast-moving consumer goods (FMCG) sector is under immense pressure: razor-thin margins, shifting consumer behaviours, rising costs, and greater demand for personalisation. In this climate, leading consumer brands are turning to artificial intelligence (AI) not as a futuristic add-on, but as a strategic imperative — reshaping everything from content creation and performance marketing to trade execution, distribution logistics, and consumer insights.

AI Content at Scale: Creative Efficiencies and Personalisation

AI has fundamentally altered how brands produce content — enabling high-volume, personalized creative at a fraction of traditional time and cost. Instead of labour-intensive manual creation, generative AI tools (from LLMs like GPT models to multimodal video generators) help FMCG marketers generate text, images and even video content tailored to specific audiences, campaigns, and platforms. This isn’t theoretical — reports show marketers using AI to generate hundreds of headlines, CTAs, ad variants, and social posts in minutes. Beyond text, brands like Mondelez (maker of Oreo and Milka) are investing tens of millions into generative video tools to cut TV and digital ad production costs by up to 50%, targeting scale without breaking budgets. Why it matters- Rapid content creation across channels

- Personalised messaging tailored to segments

- Lower production costs and faster iteration

Growth & Performance Marketing: Smarter, Data-Driven Decisions

AI isn’t just about faster content — it’s about smarter marketing decisions. Algorithms today can analyse mountains of consumer data in real-time to:- Predict which messaging resonates best with which audience

- Automatically optimise ad spend and bidding strategies

- Personalise email, programmatic, search and social campaigns

Trade Marketing & Distribution: AI for Real-World Execution

AI’s impact isn’t limited to digital channels — it’s transforming trade marketing and distribution, two areas traditionally grounded in manual workflows and gut-based planning.Trade Execution Innovation

AI tools analyze in-store data, planograms, and promotional performance to suggest:- The best shelf placements

- Optimal promotional pricing

- Real-time alerts if inventory or compliance slips

Intelligent Distribution and Logistics

Predictive AI helps forecast demand with high accuracy by ingesting sales history, promotions, weather patterns, and even regional events. These forecasts reduce stockouts and overstocks, improve route planning, and streamline delivery schedules — boosting both customer satisfaction and cost efficiency.Consumer Insights: Understanding Behaviour with Precision

Perhaps the most powerful application of AI is in consumer insights, where brands move from guessing trends to predicting them. AI analyses:- Consumer sentiment (from reviews, social channels, surveys)

- Purchase paths across digital and physical channels

- Behavioural patterns indicating shifts in preference

Challenges and Best Practices

While the promise of AI is immense, leading brands also recognise implementation pitfalls:- Data quality and integration are critical — poor data yields poor predictions.

- Human oversight remains essential to avoid algorithmic bias and maintain brand authenticity.

- Strategic alignment between marketing, operations, and analytics teams accelerates impact.

Looking Ahead: A Competitive Necessity

AI is no longer optional for FMCG brands hoping to stay relevant. Whether it’s optimizing campaigns, creating personalised creative at scale, anticipating consumer shifts, or supercharging supply chains, AI is deeply embedded across modern marketing and operations. In the words of industry analysts, the future belongs to those who harness AI not just as a tool, but as an integrated business partner — automating routine tasks while amplifying human creativity and strategic thinking. The transformation of FMCG and consumer brands through AI is not a future concept — it is happening now. The leaders who will win are those who understand how to integrate AI across content, performance marketing, trade execution, distribution, and consumer intelligence as a unified growth engine. If you want to explore how global brands are scaling AI in real business environments — and learn directly from executives, operators, investors, and innovators driving this shift — join us at Webit 2026 Sofia Edition. On 23 June 2026, Webit brings together 3,500+ senior leaders for a practical AI Business Dialogue focused on execution, growth, governance, and industry transformation. Discover how AI is reshaping FMCG, retail, and consumer ecosystems — not in theory, but in action. Learn more and secure your place: https://www.webit.org/2026/sofia/ The future of consumer brands will be AI-powered. The question is — will you be ahead of it?Announcing Webit 2026 – AI Business Dialogue

On this date, Webit 2026 – Sofia Edition will convene 3,500+ senior leaders at the National Palace of Culture (NDK) for a high-level, execution-focused dialogue on how organisations are building, scaling, and governing AI.

The agenda spans six business tracks covering capital & growth, AI-driven marketing and CX, enterprise transformation, trust & regulation, future of work, and industry transformation.

Where capital, leadership, and AI strategy align.

Save the date:

📅 23 June 2026 | Sofia

#Webit2026 #AIBusinessDialogue #AI #Leadership

https://www.webit.org/2026/sofia/

Webit Foundation convenes Trust Capital Roundtable at Davos 2026

On January 21, during the annual Davos week, Trust Capital will host a private, invitation-only Roundtable & Cocktail at Grandhotel Belvédère.

Under Chatham House Rules, a select group of the world’s most influential asset allocators, CEOs, and capital stewards will discuss where capital flows next — and which decisions will define lasting global impact over the next 3–5 years.

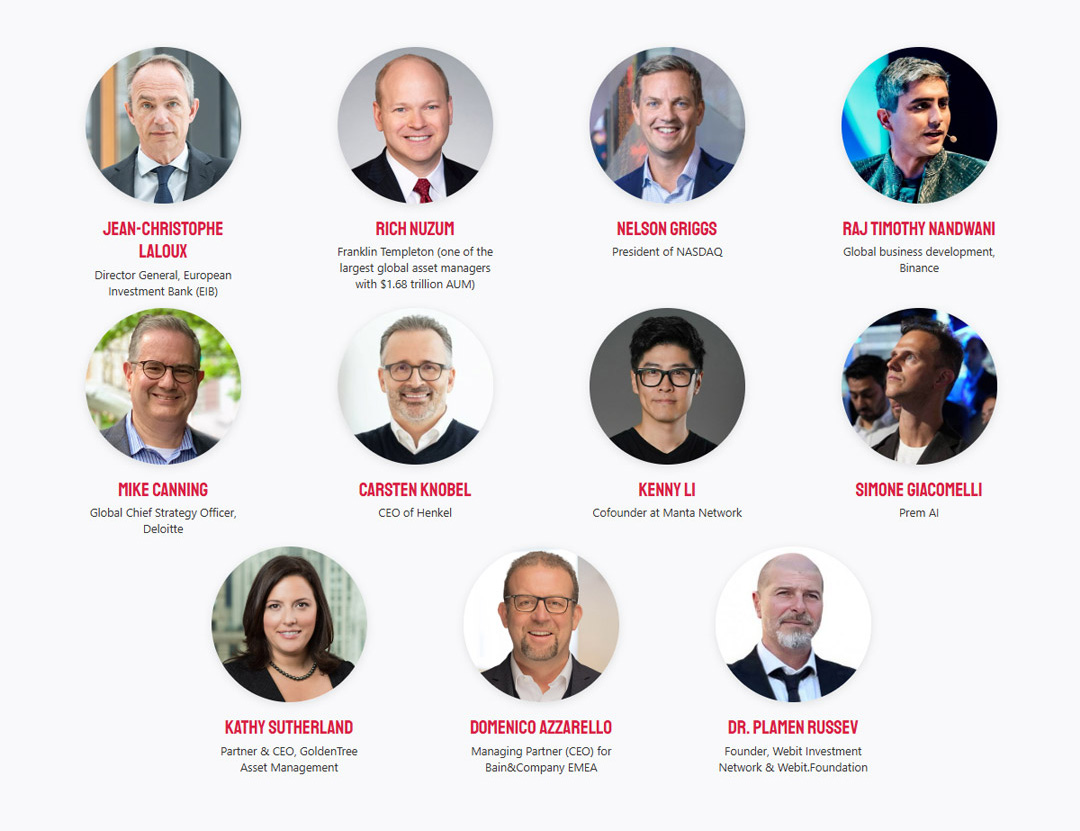

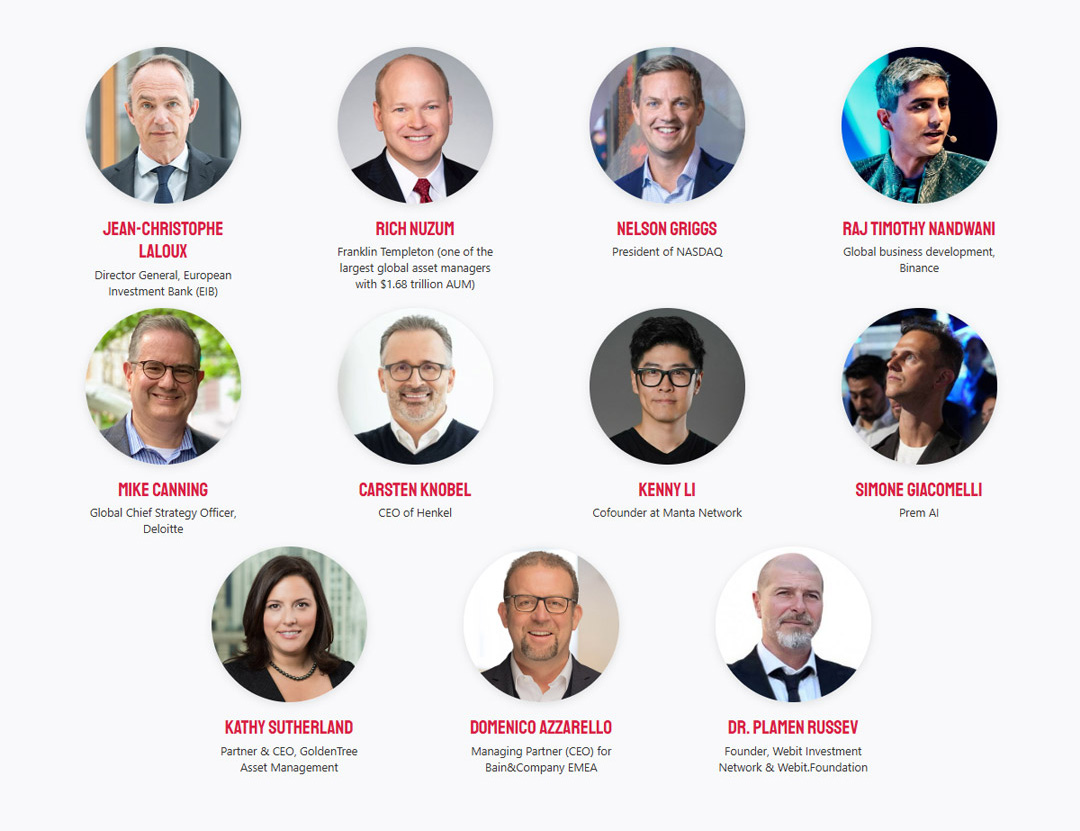

This year’s participants include:

- Jean-Christophe Laloux, Director General, European Investment Bank

- Nelson Griggs, President, Nasdaq Inc.

- Carsten Knobel, CEO, Henkel AG & Co. KGaA

- Kathy Sutherland, Partner & CEO, GoldenTree Asset Management

- Domenico Azzarello, Managing Partner & CEO, Bain & Company EMEA

- Rich Nuzum, Franklin Templeton

- Mike Canning, Global Chief Strategy Officer, Deloitte

- Raj Timothy Nandwani, Global Business Development, Binance

- Kenny Li, Cofounder, Manta Network

- Simone Giacomelli, Prem AI

- Chaired by Dr. Plamen Russev, Founder & Chairman, Webit Foundation.

📍 Grandhotel Belvédère, Davos

📅 January 21, 2026 | 14:30–16:30

🔒 By invitation only

Оfficial Event Partners: MANTA, Prem AI & Binance

For 10 consecutive years, Webit’s Davos gatherings have reached full capacity — a rare distinction during the annual meetings.

https://www.webit.org/davos/index.php

📍 Grandhotel Belvédère, Davos

📅 January 21, 2026 | 14:30–16:30

🔒 By invitation only

Оfficial Event Partners: MANTA, Prem AI & Binance

For 10 consecutive years, Webit’s Davos gatherings have reached full capacity — a rare distinction during the annual meetings.

https://www.webit.org/davos/index.php

📍 Grandhotel Belvédère, Davos

📅 January 21, 2026 | 14:30–16:30

🔒 By invitation only

Оfficial Event Partners: MANTA, Prem AI & Binance

For 10 consecutive years, Webit’s Davos gatherings have reached full capacity — a rare distinction during the annual meetings.

https://www.webit.org/davos/index.php

📍 Grandhotel Belvédère, Davos

📅 January 21, 2026 | 14:30–16:30

🔒 By invitation only

Оfficial Event Partners: MANTA, Prem AI & Binance

For 10 consecutive years, Webit’s Davos gatherings have reached full capacity — a rare distinction during the annual meetings.

https://www.webit.org/davos/index.php How Many Jobs Will AI Eliminate? C-Suite Executives Make Their Bets

Adapted from Forbes Research, October 14, 2025 Forbes

In a sweeping new Forbes Research 2025 AI Survey, more than 1,000 C-suite executives across sectors were asked to weigh in on a pressing question: Will artificial intelligence destroy jobs — or create new ones? The findings show a generally cautious optimism among top leaders about AI’s impact on the workforce.

A Moderated View on Job Loss

A dominant takeaway is that most executives don’t foresee mass job eliminations in the near term. In fact, 94 % of respondents believe that fewer than 5 % of current roles will disappear over the next two years due to AI integration. Forbes This outlook challenges the more alarmist view that AI is set to displace swathes of employees imminently. Rather, for many of these executives, the transition will be incremental and manageable.Growing Confidence in AI’s Constructive Role

Beyond limiting job losses, a striking proportion of executives—59 %—say they expect AI to generate net new job opportunities, not just eliminate roles. Forbes This is a clear shift from the prior year: in 2024, only a third of executives held this more positive view. The jump suggests greater confidence in AI as a transformative, rather than purely disruptive, force.Addressing Employee Concerns: From Fear to Partnership

One of the biggest hurdles to AI adoption is employee anxiety—especially fears about job security. Many executives named “fear of job loss” as a top barrier to successful AI rollout. Forbes To counter that, 68 % of organisations are actively reframing their internal narrative around AI. Instead of positioning AI as a replacement, they emphasize a collaborative future of human + machine. Forbes As one executive put it, “helping employees trust and adapt to new tools without fearing replacement” is essential for meaningful adoption. Forbes The sentiment is echoed in public statements from tech and retail leaders, who often stress that AI should augment human capabilities, not displace them.Workforce Realignment and Internal Mobility

Executives aren’t just talking—some are already reshuffling roles. Survey results show that 44 % of CHROs (Chief Human Resources Officers) have reassigned employees from non-AI roles into domains that overlap with AI or data work. Forbes Simultaneously, many organizations are scaling training, mentorship, and career development programs to help existing staff transition and grow in the AI-augmented environment. Forbes The goal is clear: rather than shedding people, these companies aim to reskill and redeploy talent.Uneven Adoption Across Business Functions

Where AI is applied varies substantially. 69 % of executives report using AI in IT infrastructure, technical operations, and core systems. Forbes But further down the org chart, adoption is much sparser:- Only 3 % say AI is used in HR operations

- Just 2 % note AI use in legal functions

Key Takeaways & Forward View

From the survey, a few overarching themes emerge:- Measured optimism over alarmism The prevailing view is one of cautious balance: AI is transformative, not apocalyptic.

- Narrative matters Over two-thirds of companies are actively recasting AI as a tool for human augmentation, not replacement.

- Talent is being redeployed, not eliminated Talent strategies emphasize reskilling over layoffs.

- Adoption is uneven but expanding AI’s early strongholds are in technical functions, but organizations aim to broaden use cases.

- Transition is evolutionary, not revolutionary The timeline is gradual; few expect immediate, sweeping job cuts.

10 Generative AI Trends in 2026 That Will Transform Work and...

(Adapted from Bernard Marr’s article in Forbes, October 2025)

In 2026, generative AI will no longer feel experimental — it’s becoming a fundamental part of how organizations operate and how individuals create, learn, and communicate. What began with tools like ChatGPT in 2023 has now evolved into a multi-industry revolution, reshaping workflows, creativity, and innovation.

While challenges like copyright disputes, bias, job transformation, and ethical oversight continue, the potential of generative AI — to accelerate productivity, spark creativity, and extend human capability — is undeniable. According to Forbes contributor Bernard Marr, here are ten key trends set to define 2026:

1. Generative Video Comes of Age

AI-generated video production is becoming a serious creative tool. Shows like Netflix’s El Eternauta already use AI to enhance animation and reduce costs. By 2026, expect large studios and creators alike to rely more heavily on generative tools for visual effects, storytelling, and editing.2. Human Authenticity Becomes a Differentiator

As AI floods the internet with auto-generated content, audiences will crave authenticity. Real voices, emotional storytelling, and unique cultural perspectives will stand out. The human touch — what feels “genuinely lived” — will become a key competitive advantage.3. Copyright Clashes Intensify

The debate over who owns the data that trains AI will heat up. As generative models rely on massive datasets of human-created work, legal disputes and regulatory efforts will grow. 2026 will likely see new frameworks emerge to protect creators while allowing innovation to continue.4. From Chatbots to AI Agents

AI assistants will move beyond responding to prompts. They’ll act autonomously — planning, prioritizing, and completing tasks across apps and systems. Platforms like ChatGPT’s Agent Mode, Gemini, and Claude are early examples of this transition toward proactive digital partners.5. Privacy-Focused AI Solutions

Concerns about data security are leading to demand for on-device or private-cloud AI. Businesses and individuals will increasingly seek systems that ensure control over sensitive information while maintaining high generative performance.6. Gaming Revolutionised by AI

Games will become more immersive through AI-driven storytelling, dynamic environments, and lifelike characters. Developers will use generative AI to cut costs and expand creativity — while players experience worlds that feel truly adaptive and intelligent.7. Synthetic Data for Safer AI Training

Generative AI will increasingly produce synthetic data for use in simulations and analytics. This allows organisations — especially in healthcare, finance, and research — to train models effectively without compromising real personal data.8. Generative Search Redefines the Web

AI is transforming search. Tools like Google’s Search Generative Experience and platforms such as Perplexity are blending conversational summaries with ad models. In 2026, new monetization structures will arise as search becomes more interactive and contextual.9. Scientific Discovery Accelerated by AI

Generative AI is becoming a core tool in science — speeding breakthroughs in fields like drug design, climate research, and materials engineering. AI can now generate hypotheses, simulate results, and guide researchers toward faster discoveries.10. New AI Roles and Careers Emerge

AI isn’t just replacing jobs — it’s creating new ones. Roles like prompt engineers, AI ethicists, model trainers, and AI auditors are becoming essential. In 2026, these professions will form the backbone of how organizations collaborate with intelligent systems.The Bigger Picture

As Forbes highlights, the boundary between human and machine creativity is fading fast. Generative AI will continue reshaping industries — from entertainment to science — while demanding new skills, ethical guidelines, and a rethinking of how we define originality and value. Organizations that embrace these changes with curiosity and responsibility will be the ones to thrive in the age of intelligent creation.🚀 Founders Games 2025 Applications Are Open!

Are you a visionary founder driving innovation, impact, and growth?

This is your moment to take the global stage.

If you’re:

✅ In or planning an investment round

✅ Creating measurable social & environmental impact

✅ Looking for exposure to international investors, corporates, and media

Then Founders Games is where you belong. 🌍

💡 Why Apply?

💰 FUNDING OPPORTUNITIES – For the past 15 years, winners have closed $5M–$50M rounds within months.

🎯 350+ LEADING VCs SCREEN YOU – From Sequoia, Khosla Ventures, Lakestar, DN Capital, Earlybird, and icons like Tim Draper.

🌎 GLOBAL VISIBILITY – Past winners featured in TIME Magazine, Fast Company, and other major outlets.

🎤 STAGE IN DAVOS – The Grand Finale during the World Economic Forum in front of 200+ investors.

🏆 UP TO $6M IN FUNDING AWARDS – One of the world’s biggest startup prizes.

📢 POWERFUL NETWORKS – Join Webit’s 1.5M+ global ecosystem of investors, policymakers, and innovators.

🔥 Your moment is now!

🔗 Apply here:

https://www.webit.org/en/startup_challenge_application.html/791?foundersgames

📌 Questions?

Check the FAQ or reach out — we’re happy to help!

#FoundersGames #Webit #ImpactInnovation #ScaleUp #Entrepreneurship #VCFunding #Davos #Founders

We are at FULL CAPACITY for Webit 2025 – Web3 &...

📍 Where: National Palace of Culture (NDK), Sofia

📅 When: June 26

🕗 Registration starts tomorrow at 8:00 AM (EET)

🌍 Join top global leaders in business, tech, policy, media, and startups as we dive into how AI and Web3 are transforming industries — from healthcare and finance to green innovation and beyond.

💡 Expect bold ideas, breakthrough innovations, and the people shaping the future.

⚠️ We’re fully booked and beyond excited! If you’ve secured your spot — be there early!

Let’s make history at #Webit2025. We’re expecting you. 🙌

We’re thrilled to welcome Bozhidar Doychinov, First Investment Bank, to the...

Bozhidar is a driving force behind Fibank’s digital innovation—blending cutting-edge technology with real-world usability to redefine the customer experience. He has led the transformation of the My Fibank mobile app into a go-to banking platform, introducing instant transfers, peer-to-peer payments, and even enabling users to trade stocks and ETFs directly from their phones. 📊💡

With a career dedicated to pushing the boundaries of digital banking, Bozhidar brings sharp insight into how financial institutions can thrive in a tech-driven world, while always keeping the user front and centre.

Get ready to be inspired by a leader helping shape the future of finance, one digital breakthrough at a time. 🌐💼

All participants were carefully selected and personally invited leaders from industries they represent, and now fewer than 20 public tickets for public sale are available before we close registration.

👉 Book Tickets now:

https://www.webit.org/2025/sofia/tickets.php

#Webit #Webit2025 #Innovation #Webitchangemakers