Tag: FinTech

The DApps Era is coming – the future of Blockchain adoption

Hsuan Lee, the VP of Engineering of COBINHOOD, the first zero trading fee exchange in the world, and as of January this year - came to Webit.Festival 2018 in Sofia and discussed the topic of blockchain implementation and future.

Missed the 2018 edition of Webit.Festival Europe? Don’t miss the 2019! Get your super early bird 2in1 tickets – 2 for the price of 1 here!

The DApps Era is coming

Back in 1991, many of you remember when the websites obsession was huge - the largest companies began with it. The transition towards search engines like Google and Yahoo was more or less smooth until they became viral. The appearance of sharing platforms appeared naturally - youtube, myspace, blogspots, etc. Some of the platforms disrupted and stayed, others disappeared and many, many more appeared. A couple of years ago Messenger,whatsapp and instagram, to name a few - everybody talked about these and while they’re widely used today, the hype over them disappeared. In 2017 - 2018 the most talked about technology advancements are the crypto-blockchain platforms. We are, very naturally, transitioning towards DApps era - or post apps era, role of apps is increasing and becoming more important rather than steady. All of this transition may seem ‘natural’, however, appearance and longevity process is way more difficult. Geoffrey A. Moore’s “Crossing the Chasm” theory applies to basically any sphere. Hsuan explained the technology adoption cycle in the following way: The innovators are about 2,5 % of all the population. The heart of all high tech startups is a product that spawned from a small group of passionate scientists.The early adopters take up about 13,5 %.

This is the ‘chasm’ to which companies pay little attention to once a company is over hyped by the success of market entry. This is the worst place to be, characterized by low scalability, high transaction latency and high transaction fees. The early (34%) and late (34%) majority are the largest part and the most secure phases in a company's development. There are, however, cases when the company fails - the ‘laggards’ as Hsuan calls them - are about 16% of all. Blockchain adoption by companies will be as difficult process as the transition from appearance of apps to their everyday viral usage. It will happen, however.Missed the 2018 edition of Webit.Festival Europe? Don’t miss the 2019! Get your super early bird 2in1 tickets – 2 for the price of 1 here!

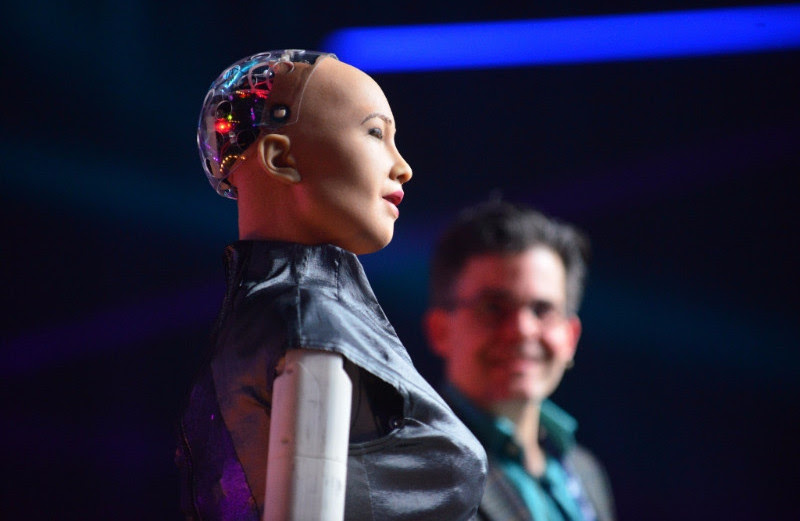

… a picture tells a thousand stories! Webit.Festival Europe 2018 was...

10'000 people from 111 countries visited the Webit City

Don't miss the 2019 edition. Book your ticket now

Webit.Festival Europe 2018 in numbers:

- 10'000+ ATTENDEES (7200 Webit.Festival participants and 3000 Webit.X visitors) - 231 EXHIBITORS - 422 SPEAKERS - 110 HOURS of conference agenda & amazing content - 75% C-level (executive) ATTENDANCE - 111 VISITING COUNTRIES - 150 of THE BEST EUROPEAN STARTUPS AND SCALEUPS - 1000+ POLICY MAKERS The European Tech, Digital Economy and Policy event for 2018 was a huge success!

The Innovate! Summit and the Plenary Session, chaired by the European Commissioner for Digital Agenda and Society Mariya Gabriel, hosted some of the worlds digital, tech and policy leaders gathered to re:Invent Europe's Future.

The Innovate! Summit and the Plenary Session, chaired by the European Commissioner for Digital Agenda and Society Mariya Gabriel, hosted some of the worlds digital, tech and policy leaders gathered to re:Invent Europe's Future.

The Webit City has welcomed 10'000 global leaders and they all requested a residency :)

Here are just 5 quotes out of over 1000 interviews with the Webit City residents: "Unparalleled global business and policy networking at its highest level!" "The most amazing business event with a festival experience" "We basically do business here" "This is the only event where top EU policy makers and global business leaders exchange thoughts and share valuable discussions" “We got more investors visiting our expo booth compared to any other event we have been to”

200+ exhibitors at over 20'000 sq.m Webit City expo & business networking area

From global tech, health, fintech, cybersecurity, mobility, blockchain, entertainment, AI, cloud leaders to smart jet fighters - they all were at Webit.Festival Europe 2018 represented by their global or EMEA HQs. Also hosted national pavilions.

12 independent summits and over 50 meetups

421 speakers have created over 110 hours of conference agenda & amazing content within 12 independent summits.

Founders Games winner of 200'000 EUR cheque is BIOO from Portugal.

Founders Games winner of 200'000 EUR cheque is BIOO from Portugal.

Cities 4.0 Summit, Digital Entertainment and Media Summit, Money Summit and Blockchain Summit

Cities 4.0 Summit, Digital Entertainment and Media Summit, Money Summit and Blockchain Summit

Webit Night Urban Summit

The Global Webit Awards Ceremony and The Chairman' Dinner by Dr. Russev

The Global Webit Awards Ceremony and The Chairman' Dinner by Dr. Russev

The World Famous Webit Party, powered by Playboy, Fashion TV and Dorcel

The World Famous Webit Party, powered by Playboy, Fashion TV and Dorcel

Webit.X - gathering and inspiring 3000 young future leaders

Webit.X - gathering and inspiring 3000 young future leaders

Missed the 2018 edition? Don’t miss the 2019! Book your ticket now at super earlybird rate

Only today! 50% off from all tickets for Webit.Festival Europe 2018!

Only today (29 May) you can join Europe's tech and digital policy event for 2018 and have access to 10+ independent summits and 50+ meetups with 1 ticket at half price!

Webit is welcoming this new era of data privacy by providing all our subscribers a special "DATA present” - 50% off from all tickets for Webit.Festival Europe 2018 only today - 29 May.

Register here and get your ticket

to join Prime Ministers, EU Commissioners and EU top policy makers, global innovators and enterprise executives, Ministers, Mayors, investors, media and Europe's top 200 startups and scaleups - all at Webit.Festival Europe with a special discount of 50% on all tickets with code: GDPR 6000 global experts (67% senior attendance) join Webit from 110 countries.Check who is speaking

Over 200 exhibitors and sponsors join Webit this year. A warm welcome to the group of new partners who join Webit including Microsoft, SAP, Samsung, Fox, Novartis, VISA, UBB, part of KBC Group, Superhosting . BG, VMware, FOX, Turner, Novartis, Bayer, Amgen, Generali to name a few. Special thanks to our General partner MasterCard and our strategic media partners Nova TV and NetInfo.Happy to help.

Should you want to join as exhibitor and sponsor - please contact us.Investments in FinTech

Though the moderator of the panel was still sitting on his plane, being late for leading the discussion, the Advisor at 8VC Jon Soberg, the founder and co-CEO of H-Farm Maurizio Rosi & the Investment Director at iTech Capital Alexey Telnov managed to deliver their experience and insights in the discussion about Investments in FinTech at Webit.Festival 2017.

Stay tuned with the latest innovations by booking a ticket to Webit.festival Europe 2018

Technology is changing everything, in all sectors, businesses and business models and has an impact on society in the daily lives of millions of people. Technology is effective once it’s combined with the next generation.

FinTech is data

Money is data too, they represent the value. As we’ve already entered a “data age”, there’s much more consciousness about the data. From online payments through digital wallets and asset management, this is a pretty vast area of settling a company and acquiring a market segment of. As for FinTech where the area has been controlled by the big banks and large organizations until recently, now we see more and more startups creating new products and truly having an impact. Even though it’s getting more crowded in the last few years, this market still provides probably the biggest opportunity that’s out there in terms of a market.One of the advantages of investing in FinTech is that one always knows where the money come from

By default, FinTech companies are dealing with money so that makes an investor’s job easier in order to track the flows. This area is fairly straightforward when it comes to a particular business model and the way the business works. The market for financial services is more than enough large so nobody has to ask questions about the size of the market or how companies in the sector will make money. The question is whether they can execute and succeed. The buzz in FInTech naturally raises the question of security: security solutions and their integration in FinTech products and services. Companies are putting more and more information on the cloud so security is a sensitive issue in all areas and needs to be paid proper attention to. Companies operating in this domain need to deal with regulations, licences and still find a way to keep their customers data secure.The transforming world of payments

Visa is not the first credit card!

Maybe it’s no news for you, but for the majority of the audience of the Red Stage at Webit Festival, it certainly was. The one who made that revelation is the General Manager of Visa for Israel, Mr. Oded Salomy. He had a keynote at last year’s edition on enabling the transforming world of payments. Visa is one of the names that probably need no introduction. “Visa” has become a nickname for our payment cards. So much, that people tend to there’s much more behind it than just a plastic for payments. Payments is such a vast area that it’s quite unpredictable what the future will bring. We never know what’s going to impact payments and the booming fintech industry. Everyday payments, business to business payments, business to customer payments and reverse.. Machines paying other machines rather than humans, biometrics being used in order to identify people by their biological characteristics.. All the way up to crypto currencies and tokens. New services, easier to work with and keeping a proper security level are needed by this ever evolving system. Numerous startups have been trying to be the next “big thing” that will shake the world of payments as the price of Bitcoin did some time ago.In the Internet of Things space things have been connecting to Fintech too

Wearables such as rings, bracelets, wrist-watches and keychains are becoming more than just accessories - there are already ones out in sale that can allow us to pay on the move. Another category that’s being impacted is the connected cars. With just an Internet connection we can pay for grocery, for gas, parking, insurance while going to work or some more without the need to get out of the vehicle. And last but not least, check the Webit.Festival website for upcoming speakers and our ticket options.M&A as a Fuel to Innovation

Sriram Prakash, the Global Lead for Innovation M&A and Venturing Services at Deloitte was one of the speakers at Webit.Festival Investments Summit who shared his insight about fueling growth through innovation M&A.

Living in an economy of expectations

An innovation can come from anywhere.It can come from a small unknown town in India, it can come from a booming city like New York, it can come from anywhere. If you want to turn your innovation into a billion dollar business though, you need some extra things than the idea itself. You need an ecosystem, you need entrepreneurs and corporates, you need the governments and different policy makers. And in fact, there are very few cities and ecosystems allowing you to do that but this doesn’t mean that your ideas can’t travel. Ideas have no boundaries anymore and that’s become quite an advantage for all market players. Markets are full of uncertainty today, they are getting saturated and there’s a backlash against globalization. For the past three years revenue growth rates has been on the decline but the share price are on the rise. That’s why innovation has become such a strong priority for companies to grow. Mergers & acquisitions is one of the ways for companies to tap into innovations happening outside of their private ecosystem rather than trying to focus on purely growing organically.More and more non-technological companies are investing in and acquiring tech companies

This means that a nowadays startup has the option of not just one but more exits and more than one sectors that could be interested in its particular innovation. The process is not one-way only. It’s not only old companies trying to go into digital. Startup companies are also buying some old style companies depending on their needs. Most of the disruptors under the scope of corporates are AI, Robotics, Big Data, Analytics and IoT, finally coming to a stage where the commercial potential can be realised. Venture capital & investment companies trying to get their way through the field should be better in the way of trying to find what people want rather than trying to invent the next Facebook or Uber. The biggest battle is for the future of consumers and the consumer industry as changing as it is. Companies of different sectors are merging and acquiring others out of their area of business and specialization. We see healthcare industry mixing with Fintech, IoT with Data and all together. For the first time there’s a genuine convergence between non-traditional sectors converging around a particular opportunity.Trends in cross-border payments

[embed]https://www.youtube.com/watch?v=OsBtydb2Pqc&t[/embed]

2017 Webit stage saw the cooperation of two people - the one with years of experience in the sphere of fintech - Michel Stuijt, the CEO of Eurogiro, and the great, innovative mind Or Benoz, co-founder of Rewire. They both investigated the trends in cross-border payments.

In his experience, Michel opens the discussion, he outlined a four expectations of what people see in the future of payments:

-

Free

-

Fast, if not instant

-

Secure

-

Full withdrawal

The main trend, the future in financial technology, lies in the cooperation.

The duo on the stage is quite a good example - the financial institution Eurogiro and the innovative products Rewire create is a great example in cross border cooperation. In 20 years time the only solution for regulation of the blockchain, fintech, trading, transactions, etc, is the good cooperation between all stakeholders. Because, let’s face it - there are few companies that create new technologies in the world today. In 5 - 10 years from now, we will see many technology companies focusing on consumer experience, making the experience amazing; on the opposite side, the financial institutions, organizations, etc, already have financial instruments, licenses and the infrastructure. The future of cross border payments lies in the cooperation between both ways.The future tech of money

Money and payments - an intriguing theme ever since way back in time, becoming more and more intriguing with each passing day. What makes it even more appealing is the never ceasing research and emerging tech innovations in the field. Blockchain, Bitcoin, international trade, digital currencies are in the focus and interest of not only corporations as a main actor, but for individuals too.

That brings the questions Kristo Kaarmann CEO of TransferWise, was trying to answer at Webit.Festival Sofia 2017. What is the future tech of money? Is it going to be Bitcoin? Ethereum? Or another type of blockchain currency? Are we still going to have banks in 10 years time or we’ll do banking on Google? Who can make a 100% certain statement and predict what and when will replace a financial system which is working, trusted and being accepted by many all around the world?

Kaarmann made an emphasis on an article published by The Guardian “Big banks earning huge profits from overseas money transfers”. Banks get their profits from different exchange rates, transfer fees, and fees on other services which are far from the cheapest option to manage one’s money. In recent years there has been a flood of fintech companies offering their solutions to individuals, corporations and banks themselves and at much more reasonable rate.

There are very few problems where tech is the only possible solution. Very often the solution lies not just in technology, but in technology and the things around it - governments, legislation, working with different institutions. For example, in fintech, that could be as specific as blockchain patterns and the governments’ enforcements on them through the more global issues such as acceptance of the new models and novelties by people. In order to find the answers of all the questions the financial system has yet to clarify, we’ll just need to wait for it to present and see.

You can watch the full keynote of Kristo Kaarmann here:

https://youtu.be/CWhI7UgRJLw

If you want to stay up to date with the latest trends in fintech, money & payments, Webit.Festival Sofia 2018 is the place for that. Visit our website and check the different ticket options.

Feel the Webit vibe with some of the best photos from this year’s event!

[easingslider id="4954"]

Central and Eastern Europe is among the leading regions for innovation...

The major advances in digital and mobile technology in the recent years caused a real revolution in the finance and payments industry and are giving us a glimpse of a world without cash. And while development like this still seem too far away, we can still see big changes, both in terms of corporate strategies and consumers habits.

This year the guests at Webit.Festival Europe had the chance to listen to Mastercard’s Digital Payments Product Leader for Central and Eastern Europe Brian Morris sharing his views on the future of payments in the region and worldwide.

The scope of his work covers the development and implementation of new digital initiatives, the formation of partnerships with local industry players, digital platform management and expansion as well as the development of an Innovation strategy.

The expert explained that right now Mastercard has over 2.3 billion cards in circulation. The main goal of the company is to make them all digital, because almost all connected devices we have today can also work as payment devices.

As a major trend in the world of payments, Morris pointed out the increased enthusiasm for the use of biometrics, like fingerprints, iris scans and facial recognition technology.

Mastercard's Digital Payments Product Lead for Central and Eastern Europe Brian Morris.[/caption]

According to Morris, the top 4 priorities for Mastercard in developing their new products and services are: the security of the bank account, the security of personal data, the speed of the process and the simplicity of the product or service itself.

If we want to put our cards into a lot of different devices we must know that our personal and banking information is secure. One thing Mastercard is doing is working on industry standards like tokenization. This means that the company is taking our data and encrypting it, so that it can be used only on the device it is stored on.

The speed is also a very important factor, because we currently live in society with no patience. If something does not happen very quick and easy, we don’t want to use it again. Simplicity in payments gives a huge added value for the customer, because this is something that we do every day. It must be simple, intuitive and easy to follow.

Morris noted that we are moving fast from a card-based society to contactless cards and that Bulgaria is among the leading markets for this in the region. But even the contactless technology is not the thing we all want. That is why Mastercard is building its fully digital environment for omni-channel reach.

Mastercard's Digital Payments Product Lead for Central and Eastern Europe Brian Morris.[/caption]

According to Morris, the top 4 priorities for Mastercard in developing their new products and services are: the security of the bank account, the security of personal data, the speed of the process and the simplicity of the product or service itself.

If we want to put our cards into a lot of different devices we must know that our personal and banking information is secure. One thing Mastercard is doing is working on industry standards like tokenization. This means that the company is taking our data and encrypting it, so that it can be used only on the device it is stored on.

The speed is also a very important factor, because we currently live in society with no patience. If something does not happen very quick and easy, we don’t want to use it again. Simplicity in payments gives a huge added value for the customer, because this is something that we do every day. It must be simple, intuitive and easy to follow.

Morris noted that we are moving fast from a card-based society to contactless cards and that Bulgaria is among the leading markets for this in the region. But even the contactless technology is not the thing we all want. That is why Mastercard is building its fully digital environment for omni-channel reach.

“These are all technology implementations and tech innovations. How the consumer feel is very important because all of you should understand that unless you start from the consumer and work back the way you will just have a nice technology that doesn’t do anything for people”, he said.Mastercard polls show that people around the world have positive feelings about innovation and the ability to use their payment cards on lots of different devices. 92% of consumers think that innovation has a positive impact on society. Around 50% of consumers are eager promoters or enthusiastic followers of digital payments. Brian Morris admitted that historically the banking and financial industry has not always looked straight at what the customer needs, but now this is becoming a much more important focus. The polls show also that the consumers prefered device for payments is now the mobile phone, while the digital customers prefer using their fingerprint more than a PIN code. Just a few years ago people didn’t want to use biometrics, because fingerprint scans were associated with criminals, police records and series of other negative factors. But now the advance of smartphones made people comfortable with using fingerprints to authenticate themselves and gives them a much better user experience. [caption id="attachment_4973" align="aligncenter" width="640"]

Mastercard's Digital Payments Product Lead for Central and Eastern Europe Brian Morris.[/caption]

According to Morris, the top 4 priorities for Mastercard in developing their new products and services are: the security of the bank account, the security of personal data, the speed of the process and the simplicity of the product or service itself.

If we want to put our cards into a lot of different devices we must know that our personal and banking information is secure. One thing Mastercard is doing is working on industry standards like tokenization. This means that the company is taking our data and encrypting it, so that it can be used only on the device it is stored on.

The speed is also a very important factor, because we currently live in society with no patience. If something does not happen very quick and easy, we don’t want to use it again. Simplicity in payments gives a huge added value for the customer, because this is something that we do every day. It must be simple, intuitive and easy to follow.

Morris noted that we are moving fast from a card-based society to contactless cards and that Bulgaria is among the leading markets for this in the region. But even the contactless technology is not the thing we all want. That is why Mastercard is building its fully digital environment for omni-channel reach.

Mastercard's Digital Payments Product Lead for Central and Eastern Europe Brian Morris.[/caption]

According to Morris, the top 4 priorities for Mastercard in developing their new products and services are: the security of the bank account, the security of personal data, the speed of the process and the simplicity of the product or service itself.

If we want to put our cards into a lot of different devices we must know that our personal and banking information is secure. One thing Mastercard is doing is working on industry standards like tokenization. This means that the company is taking our data and encrypting it, so that it can be used only on the device it is stored on.

The speed is also a very important factor, because we currently live in society with no patience. If something does not happen very quick and easy, we don’t want to use it again. Simplicity in payments gives a huge added value for the customer, because this is something that we do every day. It must be simple, intuitive and easy to follow.

Morris noted that we are moving fast from a card-based society to contactless cards and that Bulgaria is among the leading markets for this in the region. But even the contactless technology is not the thing we all want. That is why Mastercard is building its fully digital environment for omni-channel reach.

“You are able to use your digitized card on your mobile phone, your connected fridge, on your fitness device, all fully protected and secured. And the key to that is how to make this happen on all these devices in a way which make sense. With innovation it is very easy to find lots of companies doing lots and lots of very exciting and very interesting things, but the key to making it truly successful is these three elements - security, convenience and scale”, he said.The scale means it can be adopted in many many markets across many different platforms and it is easily adapted. We see a lot of emerging innovations that does not have the scale capabilities. Central and Eastern Europe is a major innovation region for payments and according to Mastercard polls it is among the top regions in the world in terms of enthusiasm and adoption of innovation. People here want to see more digitalization in transport, health and education, but to enable all this we must first solve our payments problems. Morris thinks that the key to this is focusing on the entire ecosystem, including the big technology companies, FinTech innovators and startups and government institutions. That is why Mastercard is deploying its StartPath problems for emerging companies and is contributing to Smart Transport systems around the world using the contactless card as a main driver for adopting new payment technologies. You may watch his full lecture here: If you want to keep up with the latest trend in the world of digital economy and technology, then Webit.Festival is the right place for you. Visit our website and book 2 of our Super Earlybird tickets for Webit.Festival Europe 2018 for just €100. Feel the Webit vibe with some of the best photos from this year’s event! [easingslider id="4954"]