Tag: Bitcoin

Intangible assets – blockchain relation

Do your friends ever talk about blockchain, fintech, transactions, etc.. and you just sit there not knowing what to say? Alexander Shulgin is here to bring some light and educate us on these terms.

Bitcoin, he explains, is not a currency, although we use it like that. It is in fact a decentralized distribution data based technology based on trust, used for transactions, agreements, etc.

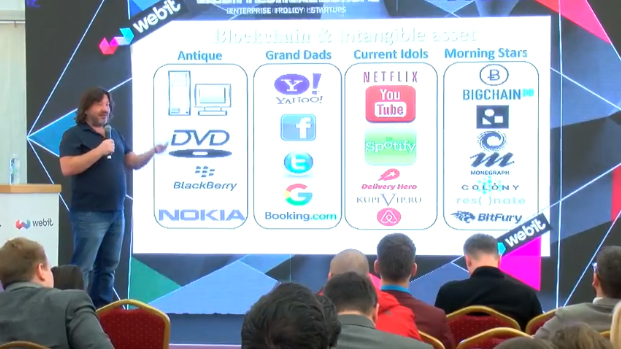

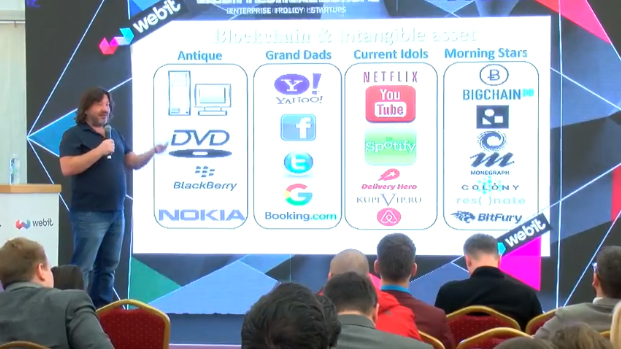

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more.

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more.

Do you believe that blockchain affects only banks and banking institutions? Well, you are wrong.

The first companies to use this technology were not banks, nor are the ones that use it today - companies like Apple, Alphabet, Microsoft, Exxon Mobile. It will disrupt firstly intellectual property, for example, as well as other intangible assets. Nowadays, a priority of all the businesses is to establish a global database for intangible assets. Without them, businesses cannot do any IoT, anything that is based on blockchain. It became clear that blockchain and Intangible assets go hand in hand, but they also create a platform for- knowledge economy and

- creative economy

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more.

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more. Blockchain can reshape the world if it deals with its security...

The Blockchain technology has the potential to lower the bank infrastructure expenses by nearly 30% if it is implemented in the right way. This will help the banks worldwide to save between $8 and $12 billion per year. But there are still many questions to be answered before Blockchain becomes the go to tech in the world of big banking, and not only.

The Executive Chairman of Alphabet Inc. Eric Schmidt described it as an incredible achievement of cryptography and said that in the modern era the ability to create something that no one can copy has a great value.

One of the main reasons for success of the internet is the constant changing of the way we transfer data, audio and video. But until now, the global network never had a method for transfer of assets. Blockchain is the technological solution, that made this thing a reality.

But still most people remain skeptical about the libertarian utopia of Bitcoin and the radical philosophy it presents. Of course Blockchain is much bigger than its most recognized cryptocurrency and has the power to be the main tool of the Big Data global infrastructure of the future.

The main concern about Blockchain remains its safety. In December, Forbes reported that hackers have stolen millions of dollars in Bitcoin, using only phone numbers. Unfortunately, unlike the credit card transactions, the transfers of cryptocurrency is irreversible.

Recently even the big industry players, like venture capitalists and entrepreneurs were hit by a wave of Bitcoin scams. Most of them are done by a phone number highjacking and changing the passwords of email accounts and bank profiles.

This type of security weakness can be used against anyone who is using their phone for services as Google, PayPal, Dropbox, Facebook, Twitter and iCloud.

In the period between 2017 and 2021 the expenses for cybersecurity worldwide will surpass $1 trillion, compared to only $81.6 billion for 2016. Meanwhile experts predict that in 2021 the total cost of cybercrime damages is gonna be around $6 trillion - double than the $3 trillion in 2013.

With the expanding of IoE we can expect around 50 billion connected devices by the end of the decade, and all of them will need to be secured. By 2020 the volume of data in internet will be around 50 times bigger than it is today.

The connected future of the world present many opportunities, but along with them will come the serious risk for our privacy and personal and financial safety.

To learn more on the topic of cyber security and privacy, visit the Security & Privacy Summit within Webit.Festival Europe. Top level speakers from all over the world will share their experience during the event, which is held on 25 and 26 of April in Sofia. You can listen to the CEO of LSEC-Leaders in Security Ulrich Seldeslachts, the CEO of Intel Security for EMEA region Raj Samani and the Co-Founder of Distil Network Rami Essaid.

During the Webit’s FinTech & Blockchain Summit speakers like the Executive VP for Global product strategy of Wirecard Christian Von Hammel-Boten and the venture capital investor and CEO of Novus Ordo Capital Liliana Reasor will share their views on topics, such as the future of payments and the ventures, driven by digitalization.

Bitcoin influenced the way payments are changing

The area of payments has never been so interesting before. In the recent years, more has happened in the area than ever before. All of this is because of the mobile phones and the Internet. The biggest change in the area has been the change of the ecosystem. With the raise of new big and small players in the mobile industry, the payments area has grown bigger and bigger. Another factor for this progress is the fact that retail and customers are ready to try to use new ways of payment, like contactless payments and some mobile paying systems, like Uber. Bitcoin and other cryptocurrencies have also influenced the way payments are changing.

A big factor for payments is regulation. The regulation coming from Europe has changed everything, leaving companies like Visa on the look for new ways to solve the problems that arise. This, combined with other factors, has led to the creation and spread of digital payments and digital currencies. It has also helped the development of mobile payments and other simpler, smarter and more secure solutions.

We have got to a point where paying with card is not more expensive than paying with cash, and are now seeing how more and more businesses start accepting cards as a way of paying. Technologies like contactless have enabled whole cities like London to run their transport system without the need of cash. Another big thing that has changed is the online check-out experience. We see new mobile wallets coming in, and the security getting better and better. The development in the whole area is driven mainly by the needs of the costumer for better experience better security and ease of use.

An important issue that has to be resolved is payments getting in the way of buying. That happens when, in order to purchase something, the costumer needs to go through a hassle to make the payment. We also need to find a balance between security, collecting data and ease of use. We want to receive as much data as possible from every payment, without exposing any sensible data and without forcing the consumer to use an obstructive technology.

Digital technology has not only changed the commerce value chain, but it has also introduced new parts to it, creating new solutions for the problems we have, but also new problems that need to be solved. Big players like Facebook, can actually have influence over the whole payment system we are seeing. In addition, digital payments make it easier for companies to tailor their offers to each consumer.

"The biggest and most used system for payments of course is Visa. The company has over 500 million cards and 15% of all the money that goes around Europe goes through a Visa card. Bulgaria has one of the lowest usage on Visa in Europe – just one out of every twenty euros is paid via Visa. But how that such a big company react to all the changes that arise? They have changed their whole investment portfolio, betting more on partnerships with new players, and less on long-term investments. Visa is working closely with many banks and big currencies in order to completely eliminate cash as a form of payment, making it easier than ever for everyone to pay for the things they want and get better and better offers", said at CEEDS'15 in April Krassimira Raycheva - Country Lead Bulgaria, Visa Europe.

Lasse Birk Olesen: Bitcoin has gone the way of every new...

Bitcoin has gone the way of every new technology – big players shame it at first, ridicule it, but soon new business, markets and even whole industries emerge in order to commercialize it. Now, according to many of the biggest names, like Bill Gates, Eric Smith and Al Gore have taken a stand for it.

However, when we speak about Bitcoin we have to answer a question: what problems does it solve, and why is it so good? Researchers have tried for decades to find a way to make all the machines on a given network to agree on the state of something, but it wasn’t until 2009 when Bitcoin was introduced, that a practical solution was found. The concept of the blockchain was created. The blockchain is a public journal of every transaction made with Bitcoin, ever since it was found.

"This blockchain is shared between all the machines, so if someone tries to cheat and create fake Bitcoins, everyone on the network can actually see that they have no legitimate history. Using this technology, everyone can send pieces of digital property to one another, without the need of a centralized structure or an expensive middle man," said at CEE Digital Summit Lasse Birk Olesen - Chief Product Officer of Coinify.Among the many problems that Bitcoin solves is reducing transaction fees and pretty much eliminating fraud. According to Golden Sax, card payment transactions cost around 125 billion euro to business every year. In addition to that another 80 billion euro is lost due to card fraud. The reason we have these huge numbers is that payment cards were invented in 1950s and never really changed much in terms of security. This technology was never designed for the Internet. On the other hand we have Bitcoin, which is designed specifically to exist in the era of Internet. There are more and more businesses that accept Bitcoin payments. One of the biggest advantages is the smaller cost of Bitcoin transactions – every transaction costs you 2 euro cents, no matter if you are sending 100 euros or 1 million euros. Bitcoin payments are also easier than card payments – instead of looking for your card and entering tons of numbers when trying to buy something, you just click a button, enter your password and you’re done. By accepting Bitcoin payments you can also get paid from any country in the world, because Bitcoin is global. For example, sending money from Uganda will mean losing around 9% of the money in every transaction. According to researches, 50% of the people don’t have a bank account, meaning they can’t do digital transactions and that their money is in danger. However, Bitcoin will enable these people to send and receive money internationally, and even apply for loans from other countries. Another great use of Bitcoin is crowdfunding. If you use a platform like Kickstarter, you pay around 8% of the raised money to the website, but in return you get a secure platform that guarantees the investors to get their money back if the project is not fully funded. However, you can do the same with Bitcoin, using self-enforcing contracts. A contract can be programmed to do a certain action under certain conditions. For example, if you get a given amount of money for a given time the money would be transferred, otherwise it would be given back to the investors. This is better than using Kickstarter, because it eliminates the middle man and it has much lesser fees. There aren’t many countries that regulate Bitcoin, but some of the ones that do are USA, Germany and Sweden. One factor that eases regulation is the fact that Bitcoin is far from anonymous. In the blockchain every transaction is linked to an account and a name, meaning that every transaction can be easily tracked back to the sender. Coinify has helped on several occasion for the arrests of criminals, using the blockchain. Even though Bitcoin is still volatile, this is a normal trend for any new currency or product and is one that will go away with time. We have seen the volatility of the currency go down and we can be sure it will settle down even further in the coming years. Wanna learn more about the bitcoin and the future of that currency, watch the archive of CEEDS'15 HERE.

Virtual wallet and the money of the future

Can you guess how many cryptocurrencies do exist on the market today? 50 maybe? Or 250? Stop wild guessing, here is the answer - more than 530 cryptocurrencies available for trade in online markets and more than 740 in total. However, only 10 of them had market capitalizations over $10 million.

Bitcoin is far away from the competition with market cap of almost 3.5 billion dollars, Second place is for Ripple with 313 million dollars. Next to them we can see Litecoin, Darkcoin and BitShares. 740 cryptocurrencies in total.

Dealing with cryptocurrencies is a win-win scenario for both sides involved as it can help boost the public status, reputation and legitimacy of the digital currency as well as the vendor. It means that when you and your company decide to work with a particular type of cryptocurrency, both parties benefit from the arrangement. Issuers of the currency are eager and proud to name the businesses that accept their product as a financial tool while you advertise in-store or on your company's web page that you accept a certain digital currency and it offers them more exposure.

Virtual wallets and online banking as well have changed financial environment. What we have here is more freedom for the customers to manage their bank accounts than before.

However, another benefit of cryptocurrencies is the anonymity of customers. When you use traditional currencies merchants can track your purchases and know everything about you in details - what you eat, what movies you watch, what you wear, etc. Digital currency offers an alternative. All cryptocurrency transactions are secure, but they don't carry any personal information at all.

The main question “Can we trust cryptocurrencies?” stays open because everyone will answer for them. Have in mind that security is the most important part of dealing with cryptocurrencies and companies keep improving in this area. To learn more about the future of money, if we will stop using the well-known paper with certain value and some other tips and tricks, book your ticket for CEEDS’15 by Webit.