Tag: blockchain

The future of Blockchain spreads way beyond cryptocurrencies

Two years ago cryptocurrencies took the world by storm, which made Blockchain the new buzzworld of businesses around the world. Today, we can almost certainly say that Bitcoin’s price will not return to almost $20 000, but this does not mean that Blockchain was all part of the natural boom and bust cycle.

In fact, the amazing technology will be a bigger part of our future than many can predict. We are hearing more and more about fintech, virtual tokens, digital assets, cryptocurrencies (not just the ones we already know), smart contracts and initial coin offerings. Each of these concepts rely on Blockchain technology.

Blockchain has the potential to influence every aspect of the global economy and its applications are already developing faster than most governments and regulators can manage. Some countries like Bermuda has already made significant regulatory advances gathering international attention.

In October 2018 the logal government has awarded the first certification for an Initial Coin Offering (ICO) under the island nation’s new regulatory regime for crypto and blockchain businesses. The legislation require ICO issuers to provide detailed information about all persons involved in the process.

The future of Blockchain will be among the main topics of Webit.Festival Europe 2019 - the largest Digital & Tech event in the continent. On 14th of May at the Industry Stage the guests of the event will be able to hear predictions for the development of this amazing technology in the next 10 years from some of the best in the business.

Blockchain has highlighted a critical aspect of the way data is going to work in the coming decades, and that is a world where data will be ever increasingly distributed. Dubai has already vowed to replace all government systems with Distributed ledger technology based digital structure by the end of next year. This indicates that DLT will only grow over time.

One of the main obstacles before the mass blockchain implementation will be the standartization and interoperability among different blockchains. The development of open standard will be the thing that will bring true benefits for the consumer of enterprise.

Experts predict that by 2030, most governments around the world will create or adopt some form of virtual currency. Despite of the fail in Bitcoin prices, cryptocurrencies have many advantages compared to the traditional alternatives. They are more efficient, provide reduced settlement times and offer increased traceability.

Cryptocurrency can also be backed by real assets, similar to fiat currency, and its price can be artificially manipulated by numerous controls. In the short term, government-based cryptocurrency will become an area of experimentation and explorations, led mostly by developing nations with unstable economies and weak institutions.

Come to Webit.Festival Europe to learn about the latest trends in Blockchain from top level experts. During the talks at Industry Stage you will be able to listen to global leaders, such as the Chief Marketing Officer of Tokyo Chapger Government Blockchain Association, Kohei Kurihara, the Co-Founder and CTO of Cindicator, Yuri Lobyntsev, the Global Ambassador of Bitfury, Marc Taverner, the Partner at Blockchain Rookies, Jon Walsh, the investor Alexander Shulgin, the Founding Partner at SpaceFund, Rick Tumlinson, the VP for Global Business Services at IBM, Johan van den Arend Schmidt and many others.

Check out the full agenda of Webit.Festival Europe here

Here you can see a full list of the confirmed speakers at Webit.Festival, while here you can get all the information you need about the tickets for the event.

What to expect from the digital transformation in 2019

The world is advancing in its digital transformation process

Being innovative and decisive, persistently driving the change, will be basic traits for any organization planning to stay competitive and live up to the expectations of our technologically thriving world. The 2019 DXC Global Digital Enterprise Survey, written by The Economist Intelligence Unit (EIU) and sponsored by DXC and Leading Edge Forum suggests that this will be “a year of decision-making and profound change”. This statement supports Diana Stefanova’s (Managing Director EMEA R&D VMware) views on digital transformation shared on the stage of Webit 2018: “Companies have to constantly innovate. If companies do not disrupt themselves, they will be disrupted by others.”

Join Webit 2019 to hear more about current technological trends and how businesses cope with them

This statement supports Diana Stefanova’s (Managing Director EMEA R&D VMware) views on digital transformation shared on the stage of Webit 2018: “Companies have to constantly innovate. If companies do not disrupt themselves, they will be disrupted by others.”

Join Webit 2019 to hear more about current technological trends and how businesses cope with them

Surveying more than 600 executives on their strategies for digital transformation

EIU reveals that the majority of businesses (over 80%) plan to increase their 2019 investments in digital technology. As numbers suggest this is by far not a hazard as 70% of the respondents confirm that organization’s profitability has increased thanks to their digital strategy. Investments in cloud computing, mobile and applications are already considered entangled to modern business, so exploring emerging technologies such as artificial intelligence, machine learning, server less computing and others, could lead to greater agility and competitive advantage. On the matter, 75% of respondents state that a modern IT infrastructure positions their organization to produce stakeholder value. On the stage of Webit 2018 we also welcomed Mikael Conny Svensson - Vice-President Government Affairs & Public Policy, Mastercard Europe, who shared his vision for Europe in 2030-2050: “Innovation is absolutely necessary, not just to do business now, but to do it in the future too”

Explore the report and find more interesting insights here

By uniting data and analysis, an organization confidently adds value to its strategy and its further implementation, however, the adoption pace is still rather imperceptive. Only less than 30% of the organizations see their business units as “digitally enabled.” Thus, fundamental to a successful digital transformation is adequate cultural transformation. About 40% of respondents state that the process should be supported by significant initiatives related to organizational change, new recruitment and training programs, digital task forces activation, as well as strong understanding and commitment from core executives to keep and guide the “digi course”.

On the stage of Webit 2018 we also welcomed Mikael Conny Svensson - Vice-President Government Affairs & Public Policy, Mastercard Europe, who shared his vision for Europe in 2030-2050: “Innovation is absolutely necessary, not just to do business now, but to do it in the future too”

Explore the report and find more interesting insights here

By uniting data and analysis, an organization confidently adds value to its strategy and its further implementation, however, the adoption pace is still rather imperceptive. Only less than 30% of the organizations see their business units as “digitally enabled.” Thus, fundamental to a successful digital transformation is adequate cultural transformation. About 40% of respondents state that the process should be supported by significant initiatives related to organizational change, new recruitment and training programs, digital task forces activation, as well as strong understanding and commitment from core executives to keep and guide the “digi course”.

As Igor Beuker, a professional speaker, serial entrepreneur and Angel Investor shared his thoughts on innovation at our 10th birthday: “Innovation is a culture, not a department!”

Get the chance to hear about it,first hand experience at Webit.Festival Europe 2019, where attendance is 75% C-level.

Evolving and moving forward to the digitization of the business has been proven to be a strategic benefit to any organization. So, if for any reason you still doubt the value of digitizing your company or industry, come to Sofia - the digital capital and get insights from the people implementing this transformation worldwide.

Like what you read? Subscribe here and never miss Webit news and special promotions!

As Igor Beuker, a professional speaker, serial entrepreneur and Angel Investor shared his thoughts on innovation at our 10th birthday: “Innovation is a culture, not a department!”

Get the chance to hear about it,first hand experience at Webit.Festival Europe 2019, where attendance is 75% C-level.

Evolving and moving forward to the digitization of the business has been proven to be a strategic benefit to any organization. So, if for any reason you still doubt the value of digitizing your company or industry, come to Sofia - the digital capital and get insights from the people implementing this transformation worldwide.

Like what you read? Subscribe here and never miss Webit news and special promotions! The DApps Era is coming – the future of Blockchain adoption

Hsuan Lee, the VP of Engineering of COBINHOOD, the first zero trading fee exchange in the world, and as of January this year - came to Webit.Festival 2018 in Sofia and discussed the topic of blockchain implementation and future.

Missed the 2018 edition of Webit.Festival Europe? Don’t miss the 2019! Get your super early bird 2in1 tickets – 2 for the price of 1 here!

The DApps Era is coming

Back in 1991, many of you remember when the websites obsession was huge - the largest companies began with it. The transition towards search engines like Google and Yahoo was more or less smooth until they became viral. The appearance of sharing platforms appeared naturally - youtube, myspace, blogspots, etc. Some of the platforms disrupted and stayed, others disappeared and many, many more appeared. A couple of years ago Messenger,whatsapp and instagram, to name a few - everybody talked about these and while they’re widely used today, the hype over them disappeared. In 2017 - 2018 the most talked about technology advancements are the crypto-blockchain platforms. We are, very naturally, transitioning towards DApps era - or post apps era, role of apps is increasing and becoming more important rather than steady. All of this transition may seem ‘natural’, however, appearance and longevity process is way more difficult. Geoffrey A. Moore’s “Crossing the Chasm” theory applies to basically any sphere. Hsuan explained the technology adoption cycle in the following way: The innovators are about 2,5 % of all the population. The heart of all high tech startups is a product that spawned from a small group of passionate scientists.The early adopters take up about 13,5 %.

This is the ‘chasm’ to which companies pay little attention to once a company is over hyped by the success of market entry. This is the worst place to be, characterized by low scalability, high transaction latency and high transaction fees. The early (34%) and late (34%) majority are the largest part and the most secure phases in a company's development. There are, however, cases when the company fails - the ‘laggards’ as Hsuan calls them - are about 16% of all. Blockchain adoption by companies will be as difficult process as the transition from appearance of apps to their everyday viral usage. It will happen, however.Missed the 2018 edition of Webit.Festival Europe? Don’t miss the 2019! Get your super early bird 2in1 tickets – 2 for the price of 1 here!

Will the blockchain industry change digital advertising?

Hristo Hristov is the CEO of NetInfo and Official Representative and Chairman of IAB. He joined Webit.Festival Europe 2018 to share some insights on the future of Blockchain in digital media and advertising.

The crypto market exploded over the last three years. A lot of industries started looking at blockchain as a technology, as to whether it can solve some of their biggest challenges.

Missed the 2018 edition of Webit.Festival Europe? Don’t miss the 2019! Get your super early bird 2in1 tickets – 2 for the price of 1 here!

The crypto market exploded over the last three years. A lot of industries started looking at blockchain as a technology, as to whether it can solve some of their biggest challenges.

Let's look at blockchain:

Blockchain as a technology is still at its infancy. We're still at the hype cycle and blockchain is sitting right next to autonomous vehicles which I don't see happening in the next two or three years and Event-triggered marketing. So as a technology, blockchain might grow into something big like the internet or even bigger, but it might also fade away into some narrow use cases.How can Blockchain improve the Digital Media and advertising landscape?

There are some use cases which are rather obvious: * Fraud detection and prevention * User Identity * Buying and selling inventory, etcCentralization vs. Decentralization

Trust a third party or to use a decentralized approach?Decentralization PROs

* Durability, reliability and longevity - Due to the decentralized networks, blockchain does not have a central point of failure and is better able to withstand malicious attacks. * Process integrity - Users can trust that transactions will be executed exactly as the protocol commands removing the need for a trusted third party. * High quality data - Blockchain data is complete, consistent, timely, accurate and widely available. * Transparency and immutability - Changes to public blockchain are publicly viewable by all parties creating transparency. All transactions are immutable, which means they cannot be altered or deleted.Decentralization CONs

* Trusted 3rd parties - it's not Central vs Decentralized. The advertising ecosystem is based on trusted third parties. These 3rd parties are innovation drivers. * It's too slow - Digital advertising is real-time. RTB standard requires service response in 100ms.There are several examples which already use blockchain in addressing some of digital advertising's biggest challenges.

adChain tries to create a token curated registry of publishers in order to verify and simplify the buying. And papyrus is a decentralized programmatic value management platform aimed to radically improve programmatic advertising stack. All of these solutions are in the making, they are not really ready but they are evolving pretty fast. Several years ago we were talking about mobile apps, then AI, now blockchain. The hype cycles of few years ago were longer and we used to have more time to adapt to them. But now they are becoming shorter and they’re starting to overlap. It wasn’t long long ago that we were talking about programmatic buying. Now it is programmatic buying on a decentralized exchange powered by blockchain.Missed the 2018 edition of Webit.Festival Europe? Don’t miss the 2019! Get your super early bird 2in1 tickets – 2 for the price of 1 here!

It is all about experience and successful business networking!

With only one month till the 10th edition of Webit.Festival Europe 2018 (25-27 June '18) we are excited to share that we have added a new special lounge for your successful business networking at the Festival!

As you know, we had to move to a new venue because Webit.Festival 2018 doubled in size.

With all the space we need now - we decided that it is time go wild!

All the 6000 attendees from global enterprises, through SMEs to scaleups/startups, academia leaders and policy makers come to Webit for 4 main reasons:- to see the future (check the speakers and Europe's top 200 startups) - to establish their place in the future (policy makers and business leaders discuss digital policy initiatives) - to connect with the right people (see who attends) - and to make successful business with them and expand their networks So we take business networking at Webit very seriously!Thus today we present to you the new Webit Fountain Networking Lounge!

Yesterday we have commissioned a company to build a brand new Dancing Webit Fountain and a water mirror around which you shall have one more unique lounge for your successful networking. The magic is that after Webit this fountain shall be no more! A fountain built for only 3 days and only for your eyes! >GET YOUR WEBIT TICKET TODAY (prices go up this week)< The New Fountain Lounge adds to the number of other special lounges you may join and have your 1:1 or group business meetings while at Webit, including: - the AI Lounge - the Cybertech Lounge - the Cities 4.0 Lounge - the Blockchain Lounge - Innovate! Lounge - the Ladies Lounge - the Platinum Lounge Looking forward to welcome you @ Europe's tech, innovation and digital policy event for 2018!Investments in FinTech

Though the moderator of the panel was still sitting on his plane, being late for leading the discussion, the Advisor at 8VC Jon Soberg, the founder and co-CEO of H-Farm Maurizio Rosi & the Investment Director at iTech Capital Alexey Telnov managed to deliver their experience and insights in the discussion about Investments in FinTech at Webit.Festival 2017.

Stay tuned with the latest innovations by booking a ticket to Webit.festival Europe 2018

Technology is changing everything, in all sectors, businesses and business models and has an impact on society in the daily lives of millions of people. Technology is effective once it’s combined with the next generation.

FinTech is data

Money is data too, they represent the value. As we’ve already entered a “data age”, there’s much more consciousness about the data. From online payments through digital wallets and asset management, this is a pretty vast area of settling a company and acquiring a market segment of. As for FinTech where the area has been controlled by the big banks and large organizations until recently, now we see more and more startups creating new products and truly having an impact. Even though it’s getting more crowded in the last few years, this market still provides probably the biggest opportunity that’s out there in terms of a market.One of the advantages of investing in FinTech is that one always knows where the money come from

By default, FinTech companies are dealing with money so that makes an investor’s job easier in order to track the flows. This area is fairly straightforward when it comes to a particular business model and the way the business works. The market for financial services is more than enough large so nobody has to ask questions about the size of the market or how companies in the sector will make money. The question is whether they can execute and succeed. The buzz in FInTech naturally raises the question of security: security solutions and their integration in FinTech products and services. Companies are putting more and more information on the cloud so security is a sensitive issue in all areas and needs to be paid proper attention to. Companies operating in this domain need to deal with regulations, licences and still find a way to keep their customers data secure.Trends in cross-border payments

[embed]https://www.youtube.com/watch?v=OsBtydb2Pqc&t[/embed]

2017 Webit stage saw the cooperation of two people - the one with years of experience in the sphere of fintech - Michel Stuijt, the CEO of Eurogiro, and the great, innovative mind Or Benoz, co-founder of Rewire. They both investigated the trends in cross-border payments.

In his experience, Michel opens the discussion, he outlined a four expectations of what people see in the future of payments:

-

Free

-

Fast, if not instant

-

Secure

-

Full withdrawal

The main trend, the future in financial technology, lies in the cooperation.

The duo on the stage is quite a good example - the financial institution Eurogiro and the innovative products Rewire create is a great example in cross border cooperation. In 20 years time the only solution for regulation of the blockchain, fintech, trading, transactions, etc, is the good cooperation between all stakeholders. Because, let’s face it - there are few companies that create new technologies in the world today. In 5 - 10 years from now, we will see many technology companies focusing on consumer experience, making the experience amazing; on the opposite side, the financial institutions, organizations, etc, already have financial instruments, licenses and the infrastructure. The future of cross border payments lies in the cooperation between both ways.Intangible assets – blockchain relation

Do your friends ever talk about blockchain, fintech, transactions, etc.. and you just sit there not knowing what to say? Alexander Shulgin is here to bring some light and educate us on these terms.

Bitcoin, he explains, is not a currency, although we use it like that. It is in fact a decentralized distribution data based technology based on trust, used for transactions, agreements, etc.

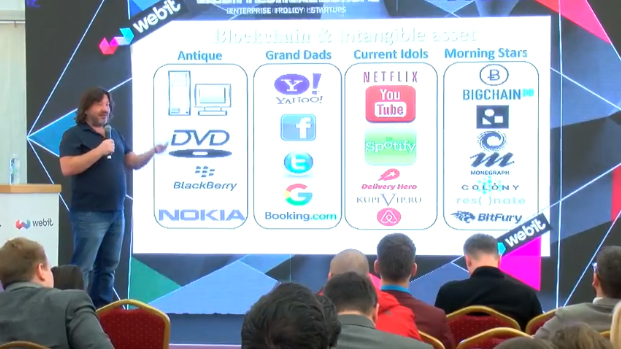

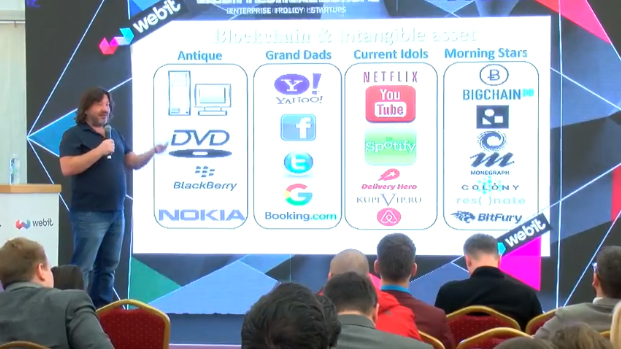

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more.

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more.

Do you believe that blockchain affects only banks and banking institutions? Well, you are wrong.

The first companies to use this technology were not banks, nor are the ones that use it today - companies like Apple, Alphabet, Microsoft, Exxon Mobile. It will disrupt firstly intellectual property, for example, as well as other intangible assets. Nowadays, a priority of all the businesses is to establish a global database for intangible assets. Without them, businesses cannot do any IoT, anything that is based on blockchain. It became clear that blockchain and Intangible assets go hand in hand, but they also create a platform for- knowledge economy and

- creative economy

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more.

The infographic shows the starts of tomorrow and they are based on patent IP and full copyright.

A case study that Alexander presents can be seen here:

[embed]https://www.youtube.com/watch?v=ZScSjPjPEqg[/embed]

Keep up with Webit.Festival 2018 agenda with a series of startup events such as the Founders Games, Startups & Investors Summit, nurturing the connection between these two intertwined parties. And more. Learn about the future of finance at Webit.Festival

World digitization process is causing massive changes in the payments industry in the recent years. And it’s not only Blockchain and its cryptocurrencies that are transforming the FinTech world, but a number of new startups that are finding new ways for moving money across the globe.

Enterprises have already realized that the key to success in the digital economy is the constant evolution, that can keep them competitive and relevant to customers.

A recent New Money survey showed that experts in this industry predict the end of cash money by 2020. More and more organizations stop accepting cash payments, while the number of customers managing their money digitally is rising rapidly.

At this year’s Webit.Festival Europe you can listen to some of the top experts in the world of finance and payments. During the FinTech & Blockchain Summit they will share their expectations about the development of money and finance worldwide and the role of technology in it.

The Global Head of FinTech at ING Group Benoit Legrand will speak about the process of digital transformation in general and the way his company is tackling the challenge of embedding innovation at its core for the last 20 years.

Novus Ordo Capital’s CEO Liliana Reasor will share her thoughts on the disruptive technology in the finance market, which accounts for $1.59 trillion in the US and the EU. She will explain how the FinTech ventures, driven by the digitization of the world, are forming the finance industry of the future.

Reasor is a thought leader in the FinTech and the finance industry and is active in several UK FinTech accelerators. She brings more than 18 years of experience in investment banking, lending, trading, investments, and FinTech from tier-one global financial institutions such as JP Morgan, Deutsche Bank, Banc of America Securities, Morgan Stanley, and Moody’s Analytics in the US and the UK. Due to her contribution to the FinTech & finance industry, she was selected as one of the Top 100 Global FinTech Women Influencers and Leaders in 2015.

TransferWise’s CEO and Co-Founder Kristo Kaarmann will share his thoughts on the time of change we live in and how technology will change the way we store money, move them between people and businesses and invest them.

The Executive VP for Global Product Strategy at Wirecard Christian Von Hammel-Bonten will talk about the future of payments from the point of view of a global leader in online payment technology for all sales channels.

Since 2011, von Hammel-Bonten has been responsible for building up Wirecard’s Mobile Payment division. In his function, he managed the launch of various mobile payment solutions and technologies and worked with telecommunication providers and banks.

The CEO of Eurogiro Michel Stuijt and the CEO and Co-Founder of Rewire Or Benoz will take part in a panel discussion about the future of payments. Stuijt is a veteran with over 25 years of experience in the financial service industry, the corporate banking business and the ICT sector. Benoz founded his company in 2015 and now Rewire offers a low cost banking solutions for internationals abroad and works with more than 10 000 clients in Israel alone.

Here you can see a full list of the confirmed speakers at Webit.Festival, while here you can get all the information you need about the tickets for the event.